It’s a carriage dispute that could deconstruct or revolutionize cable TV.

The Disney-Charter Communications brawl, which occurred during the US Open and NFL season, revealed years of tension between distributors and content providers.

ABC, ESPN, and other major Disney-owned channels were pulled off the air for Charter’s 15 million Spectrum subscribers over Labor Day weekend, angering viewers and raising existential questions for the cable industry as it became clear this was not the usual carriage battle.

Charter wants Disney to offer its users free access to its attractive direct-to-consumer offerings or more bundling options. Charter claims it pays a premium for Disney programming ($2.2 billion in 2023), although most of the buzzy content is on Disney+, not linear channels.

The battle has shown how streaming has destroyed cable and satellite providers’ economic models, with Charter admitting that “the current video ecosystem is broken” and unsustainable.

“This is not a typical carriage dispute,” Charter added. “It is significant for Charter, but we think programmers and the video ecosystem are even more important.”

Charter believes it is being charged a top-tier premium for second-quality content while Disney utilizes its lucrative carriage arrangement to construct a service that will destroy the cable bundle. It wants the remainder of the Magic Kingdom unlocked or the House of Mouse to offer more flexibility in the standard bundle so customers who don’t want ESPN don’t have to pay for it.

Disney definitely sees things differently. It feels it is still developing premium content for its linear channels and invests heavily in DTC programming, which it considers a separate offering. It says it has suggested “creative ways” to give Disney DTC to Charter users. Disney wondered why it would give Charter users free access to its premium DTC programming.

Disney stated, “Our linear channels and direct-to-consumer services are not one and the same, per Charter’s assertions, but rather complementary products.” Our linear networks continue to invest in unique content, including live sports, news, and appointment viewing. We invest multi-billion dollars in exclusive programming for our direct-to-consumer services, which complement our linear networks.

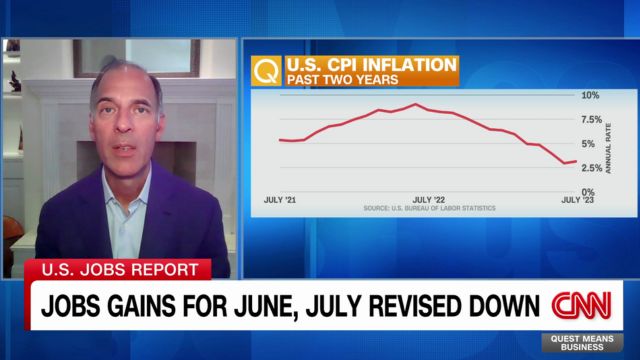

Share prices of media heavyweights fell across the board last week after reports of the unusual battle between the two entertainment giants, indicating that the outcome could affect the whole sector. CNN’s parent company, Warner Bros. Discovery, is down 9%, Paramount Global is down almost 8%, Comcast and Fox Corporation are each down 3%.

When the issue will be rectified is unknown. CNN has discovered that Disney CEO Bob Iger has been personally involved in the problem, discussing a resolution with Charter CEO Chris Winfrey. The two parties may reach a deal, but when is unclear.

Disney is now encouraging users to move to Hulu + Live TV while Charter is encouraging customers to sign up for FuboTV at a discount, suggesting negotiations aren’t nearing a settlement.

Charter has likewise taken a firm line: either it will transform the television industry’s economics or leave.

“The Walt Disney Company and Charter have the opportunity to work together on transforming the industry for the long-term benefit of both companies and their customers,” Charter said. Without them, we must switch models to value our connectivity ties. We either move forward with a collaborative business model or move on.”